Connect with us

Published

1 year agoon

Massachusetts appears to share a common link with other adult-use cannabis states like Colorado, Michigan, Oregon and Washington. Namely, the Bay State also has too much cannabis on the market, so much that demand is unable to keep up with the supply, resulting in falling prices by up to 50% since this time last year, according to an MJBizDaily report and the Massachusetts Cannabis Control Commission.

The average retail price for flower per gram averaged $7.76 in October, the most recent month with available sales data, according to the commission. In October 2021, that price was $14.38 a gram. And according to MJBizDaily, cannabis oils and extracts are seeing a similar pattern, mirroring trends in several other recreational cannabis markets.

Massachusetts voters first approved legal cannabis in the state in 2016, starting sales at the end of 2018, and these newer markets are raising red flags, especially compared to some of the more mature markets, given that the pricing drop-off seems to be even more rapid.

“In the last six months we’ve seen a dramatic reduction in both wholesale and retail pricing,” Brandon Pollock, CEO of Theory Wellness, told MJBizDaily. “For a couple years in Massachusetts, we were undersupplied in the market. It has certainly slipped to where it appears to be, there’s an oversupply. And that really happened during the second half of this year most dramatically.”

According to Pollock, the same price drop-off is also affecting wholesale flower prices, citing once again approximately a 50% drop from this time a year ago.

One reason could be increased efficiency and improved cultivation. Dennis Curran, chief operating officer of multistate cannabis operator Acreage Holdings which does business in Massachusetts. Curran told MJBizDaily that companies are getting better at cultivation, which means there are more products in the market.

The problem, he said, is that many cannabis companies built their business model off the prices they were getting in the early days of the market, when wholesale flower was selling for $3,000 a pound or more. (Pollock said a pound of flower today could sell for $800 to $1,500.)

“The difficulty these folks have is it takes several years between when you have the idea to actually getting online, let alone the whole process to do your first harvest,” Curran said. “In that interim period, when folks are doing their planning and construction, the market’s bottom started to fall out.”

While Pollock said that the price drop is keeping customers happy, the trend has caused a lot of strife for cannabis companies in the state. Earlier this month, Massachusetts lost its first recreational cannabis store since its market launch, as the Source+ shut its doors, according to a Boston Business Journal report.

Though it doesn’t seem to be all bad, as some business owners, like Major Bloom President and co-founder Ulysses Youngblood, report that business has still been steady. Major Bloom has a unique advantage, since it manufactures products but doesn’t grow cannabis. The lower wholesale costs ultimately help the company to save on input costs.

Youngblood argued that ensuring the product is affordable is essential, especially since the shop is located in a low-income neighborhood. Jason Vegotsky, CEO of cannabis sales and marketing industry Petalfast, told MJBizDaily that the state gave out more cultivation licenses than the retail demand can support, though the lower prices can help to combat the illicit market.

Cannabis companies are continuing to trek forward and bring more cultivation facilities online, though soon the state will also have to contend with neighboring states like Connecticut, New York, Rhode Island and Vermont launching their own legal markets. Pollock said that certain regions of the state will see a “noticeable impact” as those states officially launch cannabis sales.

Pollock also suggested that the state pause new applications for cultivation, a move states like Colorado have also considered, though he also recommended cannabis businesses in the state focus on branding and quality.

“If you’re going to go for the high-quality model, really double down on everything that you need to do to create that premium product that can hold a higher price point,” Pollock said.

Congressional Progressive Caucus Says Dems Can Legalize MJ By Winning House, Senate Majorities This November

Cannabis Industry Has 440,000 Full-Time Workers

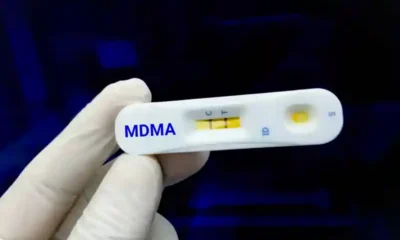

Federal Register Proposes Adding Fentanyl, Removing MDMA From Drug Testing Panels

Feds File Charges Against Maine Weed Grower After Probe Spanning 20 States

The Cannabis Market Is Booming in Japan

German Authorities to Ban Cannabis Smoking, Vaping at Festivals Including Oktoberfest